Brian Koss, professional vice president regarding Mortgage System, a separate lending company on the eastern U

S., elaborated: Having older people thinking about providing a home loan, it’s all throughout the earnings flow. When you yourself have a regular source of income, and you will home financing percentage that meets that income, it’s a good idea. Something else entirely to take on: for those who have earnings, you have got fees and an incredible importance of a tax deduction. Having a mortgage, you could write off the eye.

However there was an unappealing matter so you’re able to confront. Is the senior arriving at which get ? Brooklyn Rules professor David Reiss said as to the reasons that must definitely be asked. Seniors would be to talk about larger financial movements with anybody whose view it faith (and you may that would maybe not might take advantage of the pant.

Reiss added: What has changed in their monetary profile which is best them to achieve this? Was someone a family member, another pal egging all of them with the otherwise leading all of them through the process? Reiss is useful about caution, that’s something that might be came across.

Express this:

- So much more

- Tumblr

Such as this:

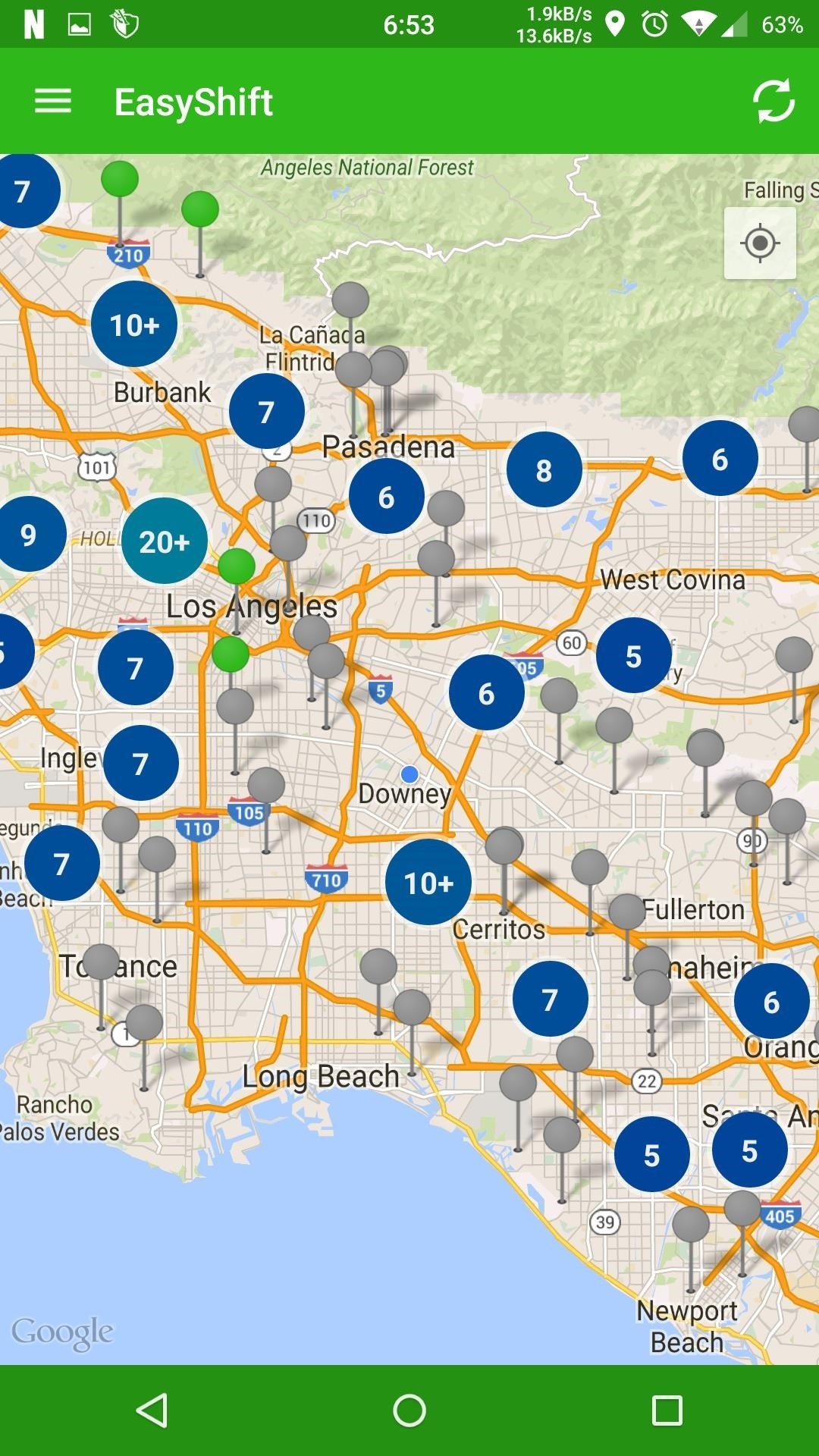

Need Ca, in which stronger domestic value numbers is actually providing of a lot people a conclusion to help you tap into their guarantee and you may spend money, according to Ca Borrowing from the bank Relationship Group.

The latest CCUL states one around 5.dos million residential property which have mortgage loans all over 11 various other metropolitan analytical elements on Fantastic County had at least 20% security since , citing research of RealtyTrac. Meanwhile, household collateral financing originations increase by the fifteen% across the exact same period of time, in order to $dos mil. Entirely, HELOCs and home security money (second-mortgages) a good increased 5% to help you more $10 mil (upwards of a low away from $9.dos billion in the 2013 but down out of $14.2 mil in the 2008), brand new CCUL records.

Your local increase home based-collateral financing and cash-aside refinancings reflects an effective federal pattern in people all the more restorations their homes and you can increasing their qualities, told you Dwight Johnston, master economist to your Ca Credit Connection League.

Fiscal experts essentially go along with one to assessment, detailing you to definitely Western homeowners went age without and also make far-called for improvements on their features and are generally having fun with house guarantee in order to beautify their homes.

Property owners is cashing in the into home equity once again as they can, states Crystal Complete stranger, inventor and you may income tax businesses director within initial Taxation, inside Wilmington, Del. Stranger states one to for many years, home values has ounts, however now home prices have risen to a life threatening sufficient height where there was security enough to acquire. This is simply not necessarily a bad situation even in the event, she says. To the flat housing market over the past ten years, of numerous residential property dependent inside the boom had been poorly developed while having deferred repairs and you will upgrades that can need to be created before they might be lso are-marketed. By using the collateral during the property so you can liven up discover maximum deals pricing is a smart investment.

You.S. people possess apparently read a crude tutorial throughout the Great Credit crunch additionally the sluggish-gains ages you payday loans in Stepping Stone CO no credit check to definitely then followed, other people say.

Before the overall economy, of numerous used household equity as the a money box getting like lifestyle expenses, says David Reiss, Professor from Law on Brooklyn Laws College or university, for the Brooklyn, Letter.Y. Of several just who did concerned regret it just after home beliefs plummeted. While the financial crisis, people which have family security was basically much more apprehensive about investing they, Reiss contributes, and you can loan providers was much more conventional on financing with it. Now, on financial crisis and property foreclosure crisis falling out on the previous, one another property owners and you will loan providers is actually enabling right up a tiny, according to him. Borrowing from the bank grew to become a great deal more available and people try taking advantage of they.