Self-help guide to Home loan Advertising Conformity toward Social media

State and federal guidelines

In terms of financial advertising, federal adverts statutes affect individual mortgages whenever you are county statutes pertain to each other consumer and business mortgages. While government legislation apply at the lenders, attempt to consult with the latest legislation of your own county in order to guarantee conformity. Right here we look at a few of the federal legislation ruled by new Government Trading Commission (FTC) and Consumer Financial Cover Bureau (CFPB).

First-point-of-email address laws

First-point-of-contact refers to income material designed to generate initial connection with a prospective customer to establish a relationship. Such sales range from many techniques from organization notes and you may stationery so you can letters, websites, and you can social network profiles. Any earliest-point-of-get in touch with topic you create loans Vinegar Bend must are the broker’s label while the licensing quantity of each representative.

Method of getting stated mortgage loans

For those who market particular mortgage terminology, this type of terms need certainly to indeed be accessible to help you a borrower. The newest misrepresentation out of a consumer’s odds of financial recognition violates Controls N, and this we’ll explain from inside the-depth less than.

Mistaken conditions

Any kind out-of adverts, including social networking, shouldn’t are one incorrect or misleading terminology that may mislead the latest debtor. This includes interest rates, fees, can cost you, taxes, insurance policies, and any potential areas of a said mortgage.

Triggering terms

The latest FTC defines one terms otherwise sentences one market certain words out-of a card agreement since leading to conditions. When this type of conditions are used from inside the social media marketing, disclosures are required. Leading to words range from the level of a loans costs, just how many costs, and you can a deposit count expressed because the a percentage otherwise an effective entire dollars amount. Instances would-be For as little as 3.5% down or 30-12 months mortgage.

Almost every other restrictions

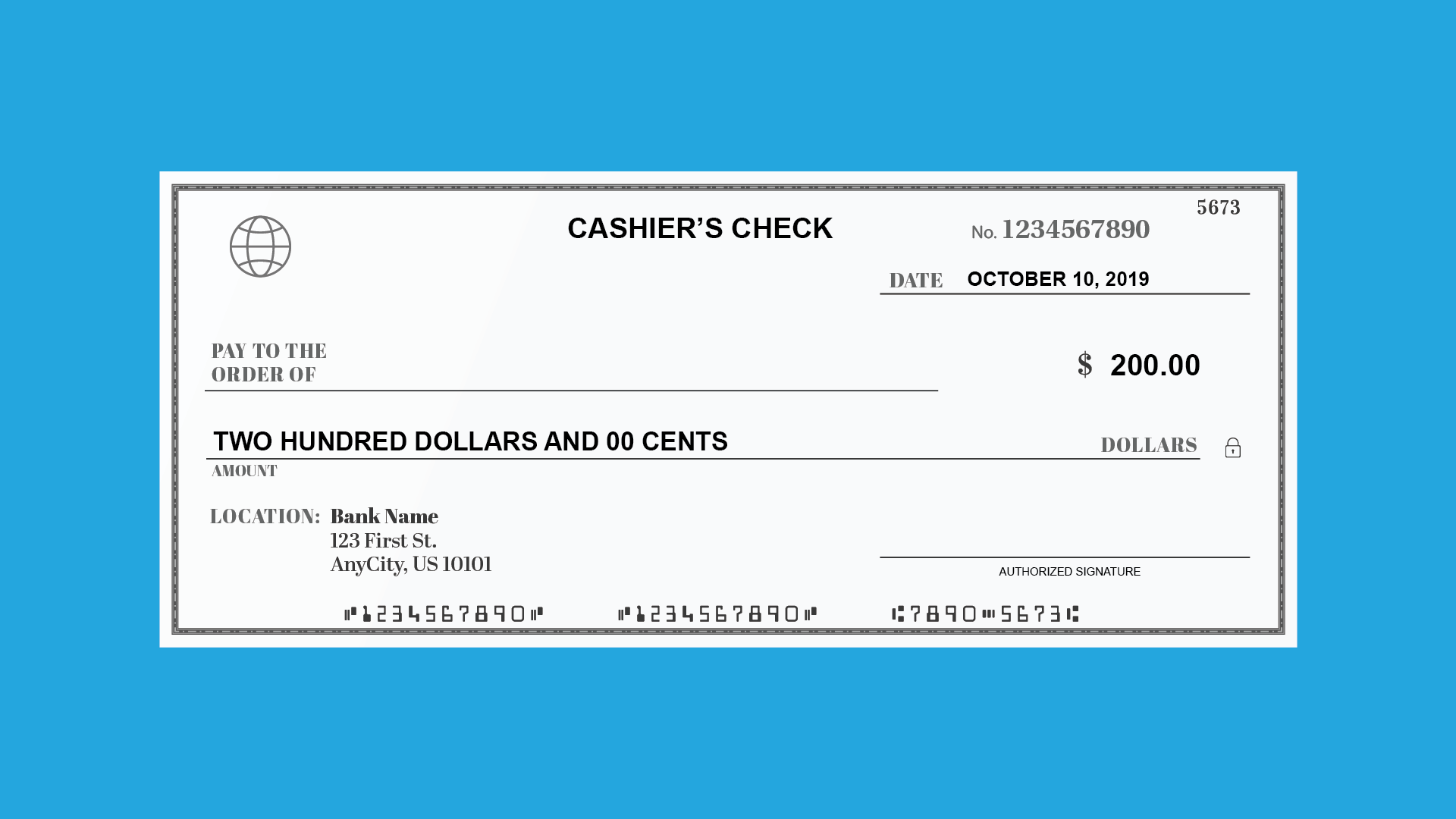

And additionally aforementioned direction, financial advertising is additionally blocked out of ads that includes the fresh new simulation from a, because they can mislead consumers to your thought he could be protected money that is not in reality open to all of them. At the same time, zero particular financial revenue is discriminate centered on ancestry, colour, disability, relationship condition, absolute supply, battle, faith, otherwise sex.

Mortgage advertising into the Fb

Of several social media programs, such as for instance Facebook, are created to assist business owners continue to be certified employing governments with respect to finding target audience. For example, when creating Facebook paigns, Facebook necessitates the entry to Unique Post Viewers needless to say entrepreneurs to determine a general potential audience which is named far more comprehensive and you may non-discriminatory.

Laws in the rates of interest

Newest rates of interest can be utilized within the financial advertisements that have standards. First off, people interest rate your market ought to be the real speed that your enterprise is already providing. Thus when your offering rates alter, you ought to instantly change your offer to mirror the newest rate or eliminate brand new offer totally. At the same time, you ought to monitor the newest apr, otherwise Apr, prominently.

Approaching financial conformity

In terms of home loan advertisements, you will find several particular laws you to mortgage brokers need to realize when you look at the purchase to stay certified. The 3 chief laws and regulations with regards to advertising become laws and regulations B, Letter, and you will Z.

1. Control B

Controls B ‘s the Equivalent Borrowing Options Act (ECOA) in fact it is designed to make sure every creditworthy people connect to help you mortgage loans. Although this regulation doesn’t provide particular ads conditions, it can exclude loan providers of strategies, including ads, you to definitely discriminate against users based on decades, ethnicity, gender, relationship standing, and nationality.

2. Control Letter

Regulation N was created by User Monetary Safeguards Agency (CFPB) additionally the FTC from the Financial Serves and Practices within the Ads legislation. So it regulation has the earliest adverts regulations to own industrial purchases content. The reason for that it controls would be to ban misleading financial ads, and additionally things such as financial sorts of misrepresentation, maybe not providing the variability of great interest pricing, maybe not exhibiting possible client charge, and never describing just how a predetermined-price mortgage can change over the long term.

step three. Control Z

Regulation Z is the Knowledge within the Credit Rules. The intention of that it controls is to try to give users into the genuine price of the mortgage and you may makes it possible for better credit identity and you can rate evaluations anywhere between lenders. Which regulation requires that most of the real estate loan adverts gets the basic facts so you can customers and will not is anything misleading. It takes new disclosure interesting costs, one another nominal and you will Apr.

Ensuring Fb income was agreeable

Into the interest in social network, social media is very important to possess company achievements and also the generation of the latest leads. not, due to the fact all lending company are at the mercy of audits, it is very important make certain your entire profit efforts, along with social media, proceed with the laws and regulations and stay certified in order to avoid fees and penalties otherwise, in the a worst-instance circumstances, a good lockdown.

Within Good Disposition Squad, we know essential prospecting is to a profitable organization. All of our Unjust Advantage program can help you improve your to generate leads and you will bottom line. Plan a method call around today to discover more about exactly how we offers your organization the new increase it takes.